Contents:

Since the option has an intrinsic value, it is always worth exercising. The advantages and disadvantages of At The Money Options are condensed and governed by its Options Leverage which can be mathematically measured. Higher percentage gain on the same move of the underlying stock than In The Money . Since an OTM option has less value than an ITM option, it usually will have a lower premium. Gordon Scott has been an active investor and technical analyst or 20+ years.

- Investors pay a higher premium for additional time as the contract will then have longer to achieve profitability from a favourable move in the underlying asset.

- In either case, $30 will be transferred from your checking account to the bookstore’s checking account.

- She feels financially stable enough to start looking for her own place again, she said, but is looking to stay not too far from home.

- B) Trading in leveraged products /derivatives like Options without proper understanding, which could lead to losses.

- When you buy an option with zero price, you are guaranteed to make a profit if the stock’s price remains the same or goes down.

- At the money forwards are considered some of the most liquid forwards in the market.

For example, a put option will be in the money if the strike price of the option is greater than the Forward Reference Rate. It encapsulates M2 data, as well as larger time deposits, institutional money market funds, money market instruments, and other large cash-like assets. The Federal Reserve stopped officially publishing M3 data in 2006, but the Federal Reserve Bank of St. Louis still tracks the figure. Currency and financial accounts might not have any value on their own, but money becomes valuable when everybody agrees to use it. Lawrence Pines is a Princeton University graduate with more than 25 years of experience as an equity and foreign exchange options trader for multinational banks and proprietary trading groups.

Out of the money options are, as the name suggests, the opposite of in the money options. They are options whose intrinsic value is zero (it can’t be negative). OTM call options have a strike price higher than the current market price of the underlying.

At the Money Options in Practice

That said, every type of money has different characteristics, and you need to choose the form of currency that works best for you. Consider issues like ease of use and value stability as you choose between currencies. You won’t be able to pay your taxes in Bitcoin, but if most of the places you shop accept it, it could make sense to use it as a form of money. De-linking the dollar from gold allowed the government to manipulate the economy and the value of U.S. currency. This allows the government to respond to economic events such as recessions. Bartering works well in limited situations, but it gets cumbersome in widespread practice.

For example, a $50 call and a $50 put will both be at the money if the underlying asset has a market value of $50. Options are most frequently traded when they are at the money. At the money refers to the situation where the strike price of an option is the same as or very similar to the current market price of the security. Both the call and put options can be at the money at the same time.

Which currency is used the most in international trade?

While there’s a wide range of possibilities for what currency can be, most forms of money are recognizable by a common set of traits. Money is anything you use to trade for goods and services and to store value. It can be any item —as long as people agree that the item has value. If a person has something to sell and wants something else in return, the use of money avoids the need to search for someone able and willing to make the desired exchange of items. The person can sell the surplus item for general purchasing power—that is, “money”—to anyone who wants to buy it and then use the proceeds to buy the desired item from anyone who wants to sell it. The money option consists of intrinsic value, and the per contract value would be more than an At money option or an Out of money option.

Supreme Court Rules Delaware Doesn’t Have Dibs On Hundreds Of Millions Of Unclaimed Dollars – Forbes

Supreme Court Rules Delaware Doesn’t Have Dibs On Hundreds Of Millions Of Unclaimed Dollars.

Posted: Tue, 28 Feb 2023 17:06:33 GMT [source]

ATM is among the three terms representing an option strike price’s relationship with the underlying security price, which is also known as the optional currency. Notice with YHOO at $15.42 there are NOT any At The Money options because the strike prices are whole numbers going from $12 to $18. Also notice how ETRADE does a nice job of shading the in the money calls and and the in the money puts to make them easy to see. Buying a put gives you the right to sell the stock for the strike price anytime before expiration.

What Does Deep in the Money Mean?

When I sell a put option below that price, at $135.00, it is considered out of the money because the strike price ($135.00) is below where the stock is trading ($139.23). If the strike price and market price of the option are the same there is no profit in exercising the option, meaning an at the money option only has time value. The intrinsic value of an options contract is the value of the option at expiration.

A put https://forexdelta.net/ that’s in the money at expiry may be worth exercising. A put option buyer is hoping the stock’s price will fall far enough below the option’s strike to more than cover the premium paid to buy the put. A put option contract gives investors the right to sell the underlying security at the contract strike price before the expiration date. A call option is in the money if the stock’s current market price is higher than the option’s strike price.

How Much Is an At-the-Money Option Worth?

But, when a call option is At The Money, the same strike put option would also be At The Money. An investor holding a call option that’s expiring in the money can exercise it and earn the difference between the strike price and market price. Whether the trade is profitable or not depends on the investor’s total transaction expense. An out of the money option — like at the money option — does not have an intrinsic value. In this scenario, the investor will not make any gains by exercising the option.

Why Investing at the Last Moment Can Hurt Your Returns – The New York Times

Why Investing at the Last Moment Can Hurt Your Returns.

Posted: Sat, 25 Feb 2023 08:00:05 GMT [source]

One is not necessarily better than the other, and it will depend on the investor’s strategy and capital allocation to determine what is best for their investment portfolio. Extrinsic value is the price of an option minus the intrinsic value. Extrinsic value is determined by the external factors that could affect an option’s price, such as time remaining until expiration and the volatility of the underlying security.

At the money options

Commodity.com makes no warranty that its content will be accurate, timely, useful, or reliable. With puts, an option is out-of-the-money if the strike price is below where the stock price is currently. We also cover the difference between intrinsic and extrinsic value, along with when an option has more intrinsic or extrinsic value based on the strike price and stock price. Money, a commodity accepted by general consent as a medium of economic exchange. The biggest advantage of having this type of option is that it has a lower risk than an At money option or an Out of money option.

Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. There is typically only one strike price that is considered “at the money.” That strike price is the one closest to the current stock price. In the chain sheet below, the at the money strike price is 550. That is because the current price of the stock is $550.80 per share. There is no other strike price closer to current price of the stock. Out Of The Money”Out of the money” is the term used in options trading & can be described as an option contract that has no intrinsic value if exercised today.

https://traderoom.info/ is the change in the price of an asset to the corresponding change in the price of its underlying asset. The delta value for an option may be positive or negative depending on the option, whether call or put. Put OptionsPut Option is a financial instrument that gives the buyer the right to sell the option anytime before the date of contract expiration at a pre-specified price called strike price. It protects the underlying asset from any downfall of the underlying asset anticipated.

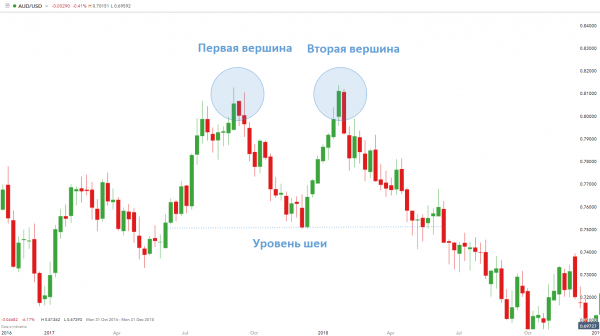

At the money options are used in specific trading strategies, and one such prominent technique is a straddle strategy. A straddle refers to a situation in which a trader will purchase not only the at the money call option but also the at the money put option of the stock. Both call and put are purchased for the same strike prices and expiration date. At the money is referred to as a situation when the strike price and market price of a security are the same. At the money is fundamentally different from in the money and out of the money options.

Among the many components of extrinsic value, you will often come across time value, or theta as it receives the most attention. It is an attributable portion of an option’s premium to the amount of time until the expiration of the option contract. At the money refers to a situation where the strike price of an option is the same as the current market rate of the underlying asset or security. If the strike price matches the cost of the stock, both the call option and put option can be at the money at the same time. If the trader decides to buy a put option with a strike price of $12 instead, it would still be considered at the money if the market price was $12. However, it would only be in the money if the underlying asset’s price fell beyond this point, but if the market rose it would be out of the money.

The https://forexhero.info/ of goods and services in markets is among the most universal activities of human life. To facilitate these exchanges, people settle on something that will serve as a medium of exchange—they select something to be money. When people use something as a medium of exchange, it becomes money. If people were to begin accepting basketballs as payment for most goods and services, basketballs would be money. We will learn in this chapter that changes in the way people use money have created new types of money and changed the way money is measured in recent decades.

What Is the Difference Between the At the Money Option and Others?

In other words, moneyness describes the intrinsic value of an option in its current state. Of these, N(d−) is the (risk-neutral) «likelihood of expiring in the money», and thus the theoretically correct percent moneyness, with d− the correct moneyness. The percent moneyness is the implied probability that the derivative will expire in the money, in the risk-neutral measure. Thus a moneyness of 0 yields a 50% probability of expiring ITM, while a moneyness of 1 yields an approximately 84% probability of expiring ITM. This is known as the standardized moneyness , and measures moneyness in standard deviation units.

Due to the expenses involved with options, an option that is ITM does not necessarily mean a trader will make a profit by exercising it. Investments in securities market are subject to market risk, read all the related documents carefully before investing. Nu Investors Technologies Private Limited do not provide any investment advice. Intrinsic ValueIntrinsic Value refers to the value that the option holds if there is no time to maturity, in a way that option is required to be exercised now itself. All efforts have been made to ensure the information provided here is accurate.

- Amounts represent money supply data in billions of dollars for October 2010, seasonally adjusted.

- But if the underlying asset’s value fell much further, it would only be profitable; otherwise, it would lose money if the market increased.

- Even if the stock is closes at your $100 strike price on expiration, you will have a $500 loss.

To make a profit, the stock itself has to rise or fall by Rs.20 to make up the cost of both option purchases. This may seem like a quick way to make money, given that the investor makes a profit, irrespective of the stock going up or down. Markets usually are more volatile, and it is tough to predict the extent of profit or loss. Implied volatility is a metric that is used to gauge the possibility of changes in an asset’s price.

Near the money and ATM options are attractive when traders expect a big movement. Options that are even further OTM may also see a jump when a swing is anticipated. Strike price is an important options trading concept to understand.